3 Min Read • October 1, 2024

Are Retirement Benefits the Answer to Hiring Challenges?

Hiring and retaining talent is one of the most challenging tasks for dealerships. While a career in automotive offers a lot of perks, like high-earning potential, the downsides of long hours and high-pressure sales environments can dissuade job-seekers. So, what can dealerships do to draw in talent?

CDK wanted to find out. In our recent workplace study, we asked 400 current and former dealership employees about different aspects of their jobs. What we learned may surprise you.

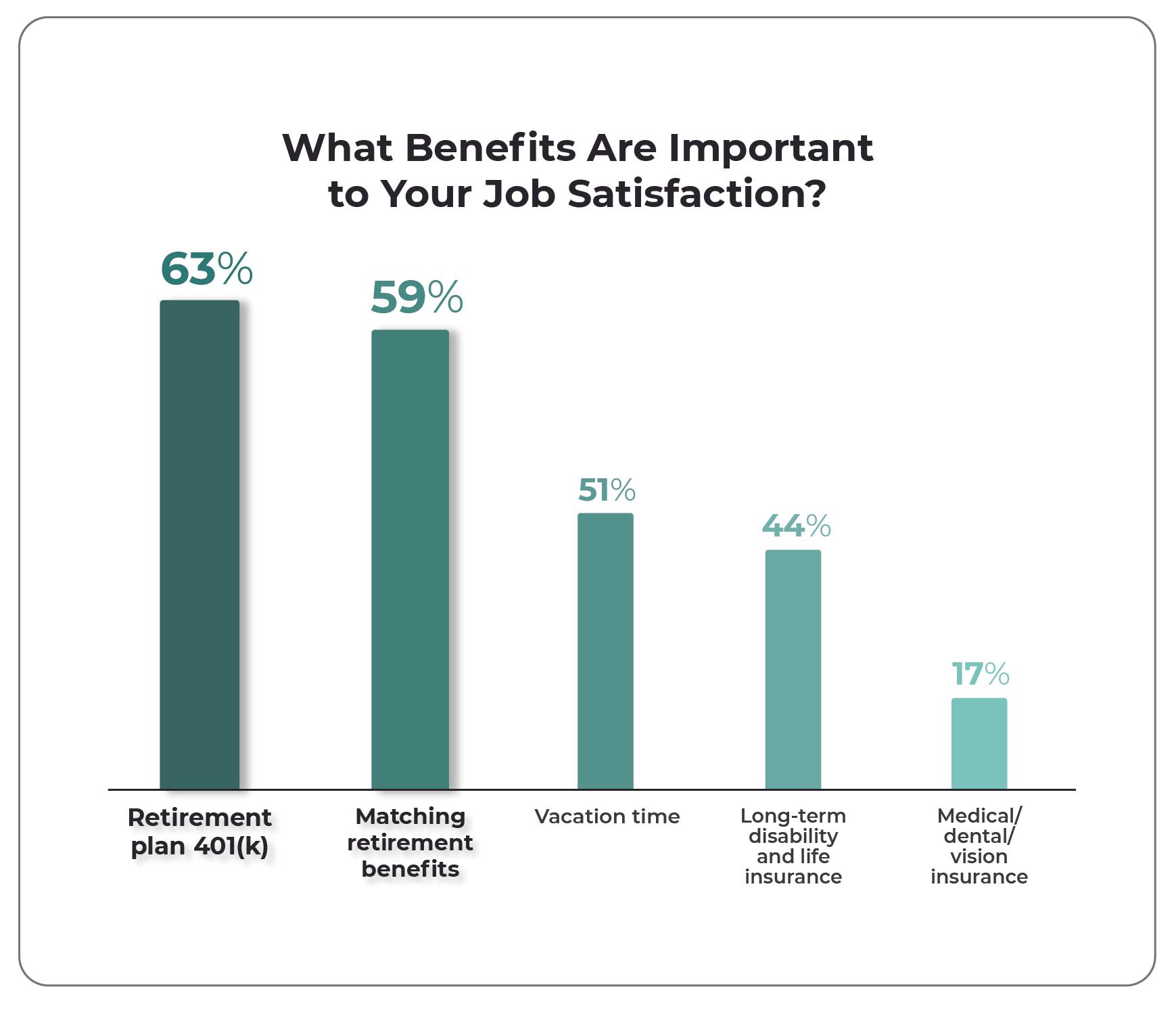

Benefits, especially 401(k) retirement plans, were a top priority for over six out of 10 (63%) of all respondents. Among former employees, 20% cited lack of retirement accounts and matching contributions as top reasons for leaving the dealership.

Among current dealership employees, nearly seven out of 10 (69%) cited inadequate benefits as one of the leading concerns driving job dissatisfaction, second only to long working hours (76%).

It’s clear that offering retirement plans will give dealerships a leg up with job-seekers. And it may help the most when it comes to recruiting young, new professionals.

Generation Z and the Dealership

CDK also asked respondents what age group they perceived to be most interested in working at a dealership. Nearly eight out of 10 (78%) pointed to Gen Z.

While respondents didn’t explain why they favored Gen Z, it’s possibly due to the size and age of this cohort. Born between 1995 and 2009, Gen Z currently accounts for about 2 billion of the world’s population and is expected to represent over 25% of the workforce by 2025. As the youngest generation in the workforce, it may be perceived that working long hours isn’t as daunting for these young professionals.

So, will offering 401(k)s and matching contributions help dealerships recruit and hire Gen Zers?

Yes.

Even more Gen Z respondents in the CDK workplace study (65%) said a 401(k) was important and it was, again, the top-ranked benefit for this younger cohort.

Across industries, today’s young professionals are serious about saving for retirement. The average Zoomer started saving for retirement at age 22, compared with millennials who started at 27, Gen Xers who started at 31, and baby boomers who started at 37.

Meanwhile, fears about the stability and liquidity of Social Security loom. Social Security’s trust funds are projected to run out in 2035. Benefit cuts will happen unless Congress acts. Many Gen Zers see it as very risky to assume the government is looking out for their retirement. They need to do it themselves, and they want their employer to pitch in.

As hiring challenges continue, dealerships would do well to research and implement retirement plans like a 401(k) combined with some kind of matching contribution. This will make dealerships more attractive to potential employees, especially Gen Zers, and help with retention. Studies have found that employees are about 40% less likely to leave their employer within the first year when offered retirement benefits.

Related

Share This