3 Min Read • February 3, 2023

Car Buyers Still Not Finding What They Want in Inventory

Car sales picked back up in January and the Seasonally Adjusted Annual Rate (SAAR) landed at 15.7 million according to NADA. Despite a prevailing sentiment that new car inventory is returning to the lots, our Ease of Purchase monthly survey of car buyers indicates shoppers are having difficulty finding the car they want.

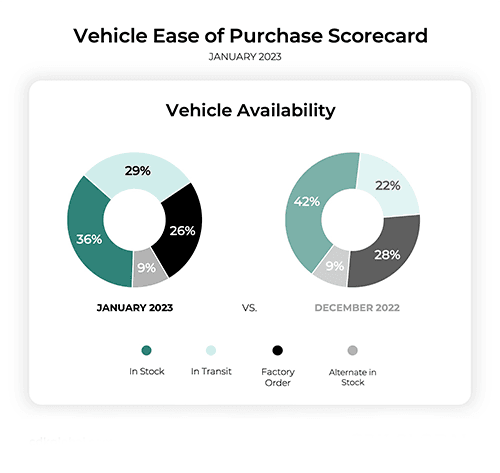

The number of shoppers who said the vehicle they wanted was in stock fell from 42% in December to 36% — the lowest we’ve seen since starting this survey in July 2022. And these shoppers had to visit more stores to find the car they wanted.

43% of the shoppers we surveyed had to visit at least two dealerships, and in December, those needing to visit four or more stores increased to 7% from 4%. Only 28% found the car they wanted at a single dealership, dropping from 30% in December.

The hunt for the right car, it seems, is still a difficult one. When we began this research, we did not expect to see the number of car buyers who ordered from the factory or in transit to remain this high. In December, the numbers significantly rose from 50% to 55%, giving us the highest percentage we've seen to date.

Another surprising finding in this month’s results is that while 82% of respondents categorized the process as easy — up from 80% last month — they felt that the specific parts of the buying process weren’t quite as rosy. Nearly all of them in fact.

In terms of finding the vehicle they hoped to purchase, 65% considered it easy, compared to 69% in December, emphasizing those pesky inventory issues.

And with the exception of filling out forms, which remained flat, every other step in the process also saw a drop. The most significant change was in applying for credit, with just 57% of shoppers saying it was easy, down from 64% last month. This is likely due to continued pressures on interest rates and fewer financing deals being offered by automakers. It’s possible more shoppers had to take an extra step to find affordable rates outside the dealership at their bank or local credit union where rates have remained more stable. More leg work on the shopper’s part could lead to this lower score.

Another puzzling finding in January was that more people said they spent less time than they expected purchasing a car, while there was nearly the same increase in people saying it took more time. That meant the number of people who said it took the amount of time they expected fell from 47% to 43%.

While you could classify all of this month’s results as perplexing, it’s clear that inventory issues are not behind us as an industry, and focusing on the purchase process can’t falter along with it. If shoppers are more prepared for longer searches and educated on the current state of credit and how to navigate it, we should see these numbers climb in the months ahead.

Share This

David Thomas is director of content marketing and automotive industry analyst at CDK Global. He champions thought leadership across all platforms, connecting CDK’s vast expertise to the broader market and trends driving our industry forward. David has spent nearly 20 years in the automotive world as a product evaluator, journalist and marketer for brands like Autoblog, Cars.com, Nissan and Harley-Davidson.